Unexpected financial needs can come at any time, which needs lot of financial assistance. Whether it’s a sudden medical expense, urgent home repairs, or a spontaneous travel plan, quick access to funds can be crucial.

This is where same-day loans or personal loans in 1-day step in to address these urgent situations.

They provide instant personal loans processed within 24 hours or even on the same day. In situations like medical emergencies, these loans serve as a crucial financial lifeline for many.

In this blog, we will help you understand how to obtain quick loans by applying online on the same day. We will walk you through the steps to obtain a same-day loan, its advantages, and the instances where such a loan becomes indispensable.

Understanding Quick Loans

Quick loans or instant loans enable people to access funds quickly, often within 24 hours or even on the same day as approval.

At Instamoney, we offer instant loans up to ₹50,000 to help meet your urgent financial needs. Once approved, you will receive the funds within just 2 hours, eliminating lengthy wait times. Moreover, our application process is entirely digital, allowing you to apply from the comfort of your home without dealing with cumbersome paperwork.

You also have the freedom to select a loan tenure that best suits your needs. Once processed, we transfer the funds directly to your bank account, enabling you to use them right away.

Quick Loans: Applying Online for Quick Disbursement

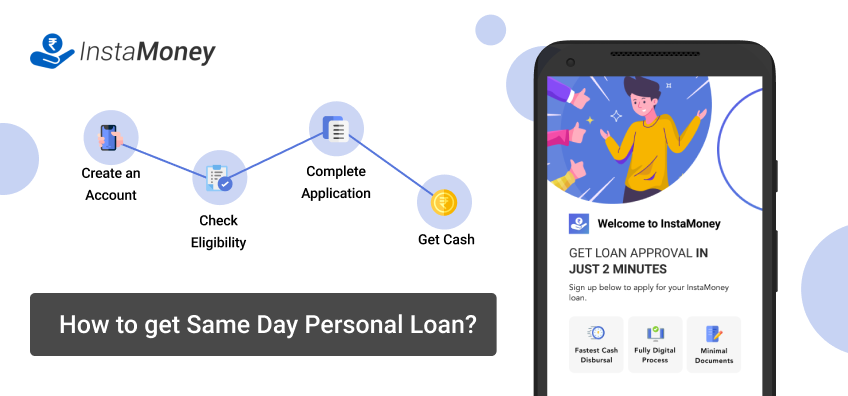

Getting a personal loan on the same day has become increasingly convenient due to advancements in digital lending platforms. So, how to get a personal loan in 24 hours?

Here’s a detailed guide on how you can secure same-day loans in India:

1. Assess Eligibility

Ensure you meet basic eligibility criteria for quick loans. Instamoney’s specific eligibility requirements are:

- Nationality: Must be an Indian citizen.

- Age: You should be between 21 to 45 years old.

- Employment Status: You need to be a salaried individual.

- Income: Your monthly salary should be above ₹12,000 and must be reflected in your bank account.

2. Prepare Documentation

Gather essential documents such as ID proof, address proof, and income proof (like recent bank statements or salary slips). You’ll need these for the online application.

For InstaMoney’s instant loans, prepare and have the following documents ready to speed up the application process:

- KYC Documents: PAN card for identity proof and valid address proof.

- Bank Statements: Your latest three months’ bank statements, showing your salary credits.

- NACH Mandate: For automatic withdrawals. An E-NACH (Electronic National Automated Clearing House) option is available for easier processing.

3. Apply Online

Once you know you are eligible and have the required documents, go to Instamoney’s website or app and complete the application form accurately.

4. Quick Processing and Approval

Instamoney quickly processes your application and documents. If everything aligns, expect approval within minutes.

5. Fund Disbursement

Upon approval, the loan amount is swiftly disbursed directly to your bank account, often within the same day. This ensures immediate access to the funds when you need them the most.

Benefits of Same-Day Loans

1. Immediate Financial Relief

One-day loans offer instant financial assistance, helping you address unexpected expenses promptly without disrupting your financial plans.

2. Streamlined Process

These loans involve minimal paperwork and formalities, simplifying the application process compared to traditional loans.

3. No Collateral Needed

Same-day loans are typically unsecured, meaning you don’t have to provide any collateral or assets to secure the loan.

4. Flexible Repayment Options

Instamoney provides flexible repayment terms, enabling you to select a repayment plan that aligns with your financial circumstances without causing undue strain.

Need for Instant Personal Loans

Here are some instances where getting an instant personal loan will be helpful:

1. Medical Emergencies

One-day loans provide financial relief during sudden health crises, ensuring you are not burdened by unexpected medical costs.

2. Wedding Expenses

Weddings often come with unexpected costs; an instant loan offers financial support to handle these without worry.

3. Home Renovation

Quick funds are essential for immediate home repairs or festive upgrades, making instant loans a convenient solution.

4. Education Fees

If school or college fees surpass your savings, an instant loan can bridge this financial gap, ensuring educational pursuits are not interrupted.

5. Travel Plans

For urgent travel, whether due to a family emergency or a last-minute decision, a same-day loan can quickly provide the necessary funds.

Conclusion

Unexpected financial needs can arise at any time, demanding immediate solutions. Same-day loans or instant personal loans within 24 hours play a pivotal role in addressing these urgent situations, serving as a lifeline for many, particularly during medical emergencies.

At InstaMoney, we prioritize swift access to funds, offering quick loans online on the same day, up to ₹50,000, with a seamless digital application process. We disburse funds within just 2 hours, minimizing wait times. These loans entail minimal paperwork and boast flexible repayment options, ensuring hassle-free financial relief.

Whether it’s medical emergencies, wedding expenses, home renovations, education fees, or travel plans, quick loans on the same day deliver timely support, securing financial stability when it’s most needed.

FAQs

1. How do I Immediately Get an Instant Loan?

To obtain an instant loan immediately, apply online through a digital lending platform like InstaMoney. Ensure you submit the required documents and meet the eligibility criteria for quick approval and disbursement.

2. How to Get a Rs 50,000 Loan Urgently?

For an urgent Rs 50,000 loan, select an online lender that offers rapid disbursements. Complete the application form and provide all necessary documentation to expedite the approval process.

3. Is it Possible to Receive Money on the Same Day You Apply for a Personal Loan?

It is indeed possible to receive money on the same day you apply for a personal loan. Opt for lenders that specialize in same-day disbursements and meet their fast-tracked approval criteria.

4. Is it Possible for Individuals With Poor Credit to Obtain Loans Within 24 Hours?

Individuals with poor credit can still obtain loans within 24 hours. Look for lenders specializing in bad credit loans, although be prepared for higher interest rates and stricter terms.

5. Are there any processing charges for same-day loans?

Yes, processing charges typically apply for same-day loans. These fees cover the cost of quick processing and immediate fund disbursement. Lenders usually disclose these charges during the application process