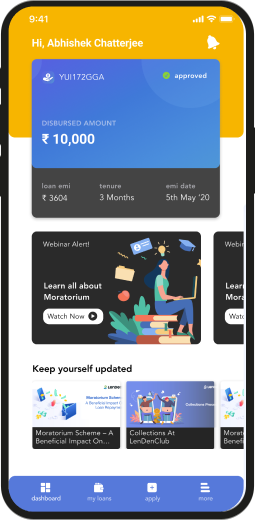

Instamoney Instant Personal Loan App

Get upto 50,000 instant personal loans from InstaMoney app. Enjoy the benefits from low credit score to affordable interest rates. Seamless amount transfer to your bank account in less than 2 hours. Fulfill your dreams with InstaMoney Instant Loans easy approval with minimum documents required.

Eligibility & Documents Required for Instant Personal Loan

Steps to Apply for Instant Personal Loan

1. Check Eligibility

Visit the InstaMoney website or download the app, enter all the necessary details, and you will receive your eligibility status within 2 minutes.

2. Choose Loan Duration

Select your preferred loan amount and repayment period from the available options.

3. Upload Documents

Upload all the required documents online for verification.

4. Loan Amount Disbursed

Once your documents are verified and the loan agreement is submitted, the approved amount will be transferred to your bank account within 2 hours.

EMI Calculator

Calculate your personal loan EMI with Instamoney EMI Calculator to plan you EMIs.

EMI Calculator

Monthly EMI

₹5935

Total Interest

₹212211

Total Amount: ₹712210.61

Loan Amount: ₹500000.00

Interest Rate: 7.50%

Personal Loan by Amount

Personal Loan by Needs

Personal Loan Types

Personal Loan Location

FAQ - Frequently Asked Questions

Get answers to your questions about our awesome app! Learn more and explore its features now.

1. Is InstaMoney regulated by RBI?

Yes. InstaMoney, registered under Innofin Solution Pvt ltd, is one of the very few players in India who are registered as NBFC – P2P (Non-Banking Financial Company – Peer to Peer) with RBI.

Click Here to check the List of RBI Registered NBFC P2P

To read this in Hindi Click here

2. What is InstaMoney?

InstaMoney instant personal loans, providing an easy solution to your financial needs.

Trusted by over 1 crore Indians, InstaMoney simplifies borrowing in India with a quick and fully digital process. Our goal has always been to eliminate the complications of traditional borrowing and help every individual who requires financial help.

3. How do I apply for an InstaMoney loan?

To apply for an Instamoney loan, you need to download the Instamoney app from the play store on your phone. App Download Link: READ MORE

4. What documents are required to avail InstaMoney?

We only require 3 documents from you to approve your loan:

READ MORE.

5. Is my personal and financial information secure at InstaMoney?

Every webpage of InstaMoney is secured by COMODO Secure SSL. This ensures that any data you submit to InstaMoney’s website over an HTTPS connection is securely encrypted with the strongest available algorithms.

We care for your security and it is of utmost priority at InstaMoney. You can also review our Privacy Policy

Read latest from blog

Stay in the know! Read our latest news from the blog

for up-to-date information.

How To Increase CIBIL score